Sep 6, 2016

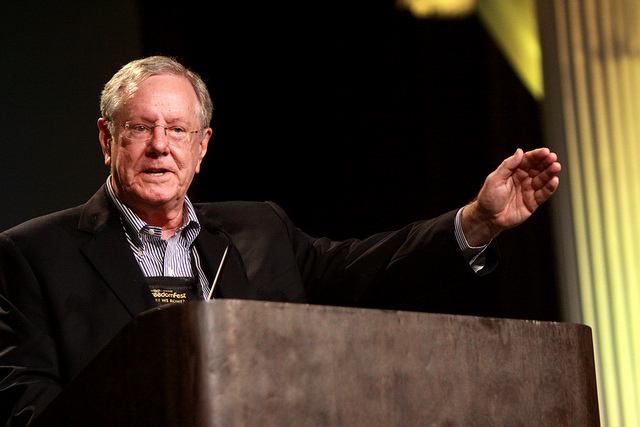

An Afternoon with an Icon: Steve Forbes

Recently, I spent a few hours with Steve Forbes in Nashville. Forbes, the editor-in-chief of Forbes magazine and a two-time candidate for the Republican presidential nomination, is truly a gentleman of grace and probity.

When Steve arrives, he is humble, relaxed and has a hint of mirth in his eyes. We sat down to discuss a number of different topics ranging from the economy and investing to healthcare and the current presidential race. Steve’s knack for explaining difficult concepts in simple terms is incredible. I am reminded of my grandfather teaching us how to fish or showing us how to cook– Steve is very matter of fact, genuinely interested, judicious with words, and uses relevant metaphors to really lock in the learning.

Steve’s quick and easy explanations illuminate concepts we routinely read about online or hear on CNN, but may not fully grasp or are too shy to ask about.

Steve, a lot of us admire you for your financial prowess and grasp on finance. A simple question for you – “what is money?”

Great question. Many people misunderstand that money is just a measure of value, the same way that scales measure weight or thermometers measure temperature. Money is nothing more than a creation to measure those values, and it was borne out of logistical necessity. Going back thousands of years ago, there was a barter system. The goat farmer needed eggs, so he would trade goat milk for a dozen eggs. Maybe the goat farmer needed building materials, so he would trade a few goats to the lumber supplier. The lumber supplier would then take a goat to the textile merchant to get a roll of fabric to make clothing from, and so it would continue.

Back when our needs were simpler and there were fewer suppliers and products, the barter system worked very well. As we became more advanced as a society, we needed to standardize our marketplaces and the exchange of value. Can you imagine going into the Apple Store to get your iPhone and you walk in with a sheep? Except they don’t want sheep today, they need eggs and goat milk. Money was created to standardize the buying and selling of goods – and it’s only a measure of what people are willing to pay for certain goods or services.

Bottom line, money makes buying and selling easier. It’s a claim check that is based on trust. If we can’t trust the money, we can’t trust each other, and that creates serious social issues – which we are facing today.

People talk about money and wealth as interchangeable. It sounds as if you’re saying this isn’t correct?

Right, money is not wealth. It is a measurement of wealth – again, just like a thermometer or scale. Another example would be a ruler – it measures inches but it is not actually those inches. The ruler never changes but the inches can increase or decrease, regardless of what the ruler does. The measurement itself is fixed.

Can you explain to us a bit about the value of money during these economically interesting times?

One of the larger questions today is how volatile markets and currency fluctuations impact the value of money. Is it a fixed value (not likely), or what will we get back on our money in the future? If I put $100 into this bank, this investment or this speculative play, what will I get back? There are issues, such as stagnation of investment or those created by policy makers, the ‘Fed’ for instance, who believe that if we create more coat checks, we will get more customers in the restaurant. That’s not a viable long-term solution. Going back to the ruler analogy: the Fed believes that creating more rulers will stimulate the economy — but that again is not the best go-forward solution. Reviewing history, going back to the Depression, we have to be careful not to put the cart before the horse.

How about the U.S. dollar and how it relates to other currencies? Lately, the dollar has been getting much stronger.

Here’s an interesting statistic: from the 1790’s to the 1970’s, the U.S. Dollar was fixed to gold and most other currencies were fixed to the dollar. There was very little currency trading in those days. Today, currency trading is valued at $5.5 billion per day, which is more than both stocks and bonds. Think of the immense brainpower that goes into trading these currencies. Wall Street rises and shrinks based on this uncertainty of value (the measurement of that value, as we have been discussing) and the time horizons are shrinking too.

Tell us about the Fed: friend or foe?

Send the Fed to North Korea (he chuckles). They don’t understand that their sole function is to keep the dollar stable. The Commerce Department oversees the Department of Weights and Measures. Should they be able to impact the Fed or the value of our currency? No. The Fed should be around only to implement an occasional fix to our economy, and nothing more.

Earlier we discussed that “money isn’t wealth” – unpack that a little more for us.

Wealth is what we should be thinking about to secure our futures. Wealth is what we create, not what we measure — though this can change very quickly. Today we live in an era of ‘you can sleep well or eat well’ but not both. We need to be looking to the future and adjusting accordingly. We should think of Peter Drucker and remind ourselves what we are trying to do – and if this means that we need to change for our purpose, then we should.

The definition of wealth is changing. How do we define wealth today? Look at the steel industry. 30 years ago, we discovered we could recycle material to make steel. Everyone went down but U.S. Steel. It all depends on what we perceive things are worth. Ultimately it’s intangible. We tend to think of piles of gold or Scrooge McDuck with all his money but it’s not really like that.

Here’s another way to think about it. The first Forbes list in 1982 was made up of Rockefellers, Duponts and the like. Today, there is only one on the list — David Rockefeller — and he’s 100 years old. Achieving wealth is not a passive act by any means; there is not a lot of rest involved in the accumulation or retention of wealth.

In recent years, overvaluing things has driven prices up artificially. Take oil, for instance. Based on the average historical price, it should be $21 per barrel. Fluctuation in price is being caused by the uncertainty about our dollar.

Author’s note: According to Peter Zeihan, a geopolitical expert, oil prices for the next decade will be approximately $25 per barrel in the United States and over $100 globally (based on OPEC’s impending pricing increase). Zeihan attributes this to the emergence of new technologies for drilling and the resources available to the United States.

Steve, you’re clearly an astute investor. Any tips for the folks out there who are looking to invest?

Emotions are the worst enemy when people invest. Warren Buffett speaks of this often. Most folks are better off investing in good mutual funds with a blend of investment strategies. One good strategy is to think of your investments in two different categories: your retirement fund and your ‘Warren Buffett’ fund. The first should be secure, but the other can be a bit more aggressive; perhaps some index funds with low fees. On annuities, be careful of fees (for that matter be careful of all fees). Funds with a blend of income and equity appreciation are a good thing. On the retirement fund, don’t be Babe Ruth; don’t try to knock it out of the park. Just be conservative. For the younger investors, you can ride the market over time. It will be your friend if you stay in. It’s not for the feint of heart though. Sometimes the market can be very good (as it has been these past years) and sometimes it can be nasty.

What about social security, any thoughts there?

Today, there is no money in the social security system. They usually go to the treasury to get money, but who wants to sell or buy bonds for this? I saw this issue coming about 20 years ago and proposed that younger people should have personal accounts for retirement that followed proper rules for a diversification/portfolio mix.

Any thoughts on what’s happening with healthcare?

Today, we’re faced not just with higher premiums as individuals — let’s think about the ‘real cost’ of healthcare. Add up what we each pay, what our companies pay, then state tax: about one-third of that goes to Medicaid and a good portion of FICA goes to Medicare. Over a lifetime, people can spend around $1,000,000 on healthcare.

Another pertinent question: ‘Who is the real customer with healthcare?’ Motel 6 is probably better than our healthcare system when it comes to customer service. They know who their real customer is. Hospitals should be required to post prices for services (like fast food places do on their billboards) and rates should be nationalized, not variable from state to state.

With the upcoming elections, there’s a lot of attention on Mr. Trump. Any thoughts there?

(Steve’s face lights up and an ear-to-ear grin appears. He’s thoughtful for a moment and then speaks.)

Well, at least with Trump, debate ratings match those of a reality TV show – even if you have ‘Naked in the Jungle’ airing that night. What he has tapped into though, as has Bernie Sanders, is a very deep frustration over the rut that America is in. Even though Trump is all over the place and inconsistent, by God, he loves the U.S.A. Several years ago, another candidate tapped into similar dissatisfaction, and that was Ronald Reagan.

You’ve been quite outspoken about regulations and taxes. How would you best sum up your thoughts for folks who don’t have the same grasp on these issues?

Big government is not efficient; those at the top believe that complexity is a source of power. There are so many regulations; it’s time to ask why. Why are you putting these barriers in our way? Who do they benefit, who do they protect, is there any harm without these regulations? New York for example has lots of new regulations that should be looked at carefully. Taxes? The government needs to simplify the tax code and start all over again with a flat tax. Small business has become the unpaid tax collector, and that’s got to stop if we want our companies to continue to greatness.

As we wrap up, Steve, do you have any good financial tips?

Well, this is not an insider tip by any means – while the Fed is wrecking the economy, take advantage and get the cheapest mortgage you can. We will not see interest rates this low in my lifetime, that’s a certainty.

Walking away from my conversation with Steve Forbes, something he said really sticks with me: “complexity is a source of power.” Many federal and large scale institutions are purposefully complex, but that does not mean that they are inaccessible. Be aware of complexity, but don’t be overwhelmed by it, and don’t hesitate to inquire further when something is not clear. Steve has given us a lot to think about. Now more than ever, with the upcoming presidential elections and with several economists predicting that we are in the midst of another bubble, Steve encourages that we always ask “why?” In doing so, we can remain informed and able to make the best decisions for our future.

Ken Sterling is the Chief Learning Officer and Chief Marketing Officer at BigSpeak Speaker’s Bureau – the leading keynote and business speakers bureau in the world. He holds a Ph.D. from the University of California and an MBA from Babson College. Ken teaches Entrepreneurship, Marketing and Strategy at UC Santa Barbara. He is a serial entrepreneur, keynote speaker, business consultant and sales & marketing expert. For press interviews, contact marketing@bigspeak.com.

(Image credit: Gage Skidmore, flickr)

Speaker

Tags

Dr. Ken Sterling, MBA & Esq.

Dr. Ken Sterling, MBA & Esq.